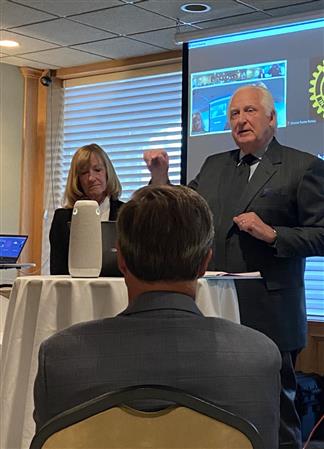

The club welcomed Tom Youngblood and Cathy Champion, seasoned realtors of the Pointes, to share their perspective on the current market and property tax assessments.

With the Headlee Amendment in 1978 and Proposal A in 1995, the amount that a homeowner’s property tax can be increased in a given year has been capped to avoid large fluctuations. The maximum increase is 5%. A home’s assessed value is determined at the end of the year and a Notice of Assessment is mailed out by the municipality in February. It contains the Assessed Value (SEV), which reflects 50% of its true cash value (which can go up or down by any amount) and a Capped Value. The taxable value is either the SEV or capped value, whichever is less. With the cap, if one owns a home for a number of years, the home’s taxable value can become much less than its assessed value. This amount is reset when a house is sold, and that new taxable amount will show up in the calendar year after purchase.

Homeowners can appeal their assessment before a Board of Review (using GP Farms rules). It’s up to the individual to present information as to why their assessment is wrong and it’s recommended to hire a realtor or a fee assessor to determine the amount. If dissatisfied with the review, the next step is going before the State Tax Tribunal.